Introduction

After the onset of the Covid-19 pandemic, the US drugstore sector played a significant role by dispensing medication, administering vaccines and expanding telehealth services. Now, the drugstore sector is looking to transform its role and expand its health services offerings.

We discuss the size and growth of the US drugstore sector and important factors that drive its expansion. We also analyze the sector’s market performance and outlook, online market, competitive landscape, innovators and the themes we are watching in 2022 and beyond.

Market Scale and Opportunity

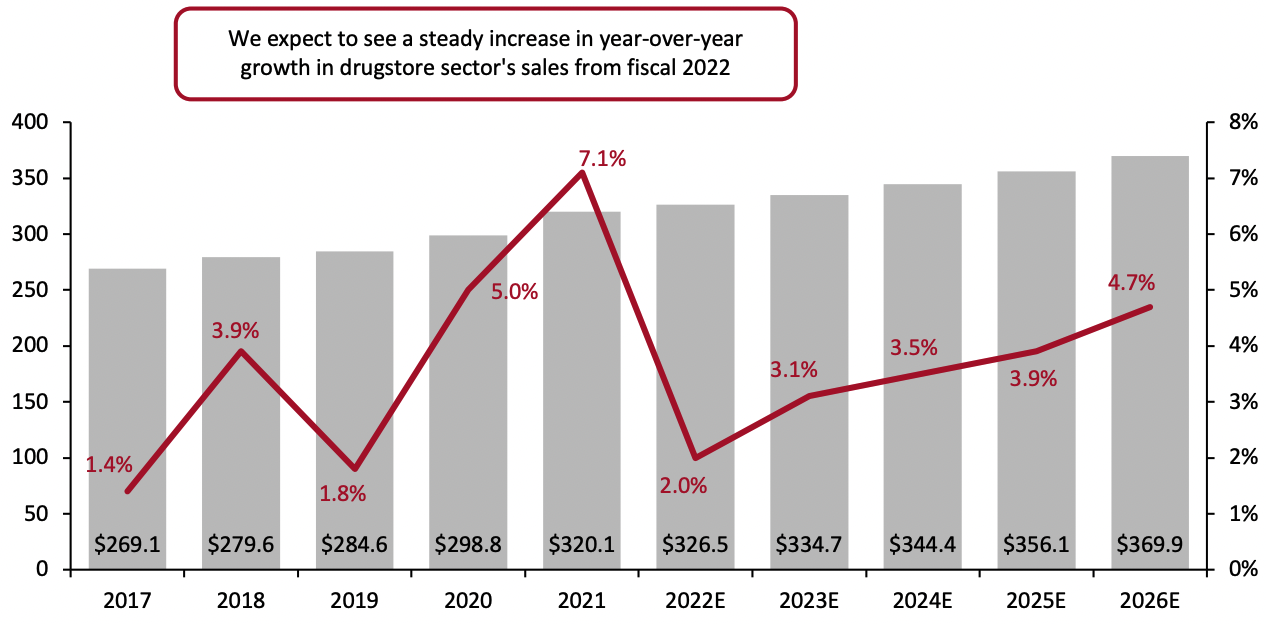

Coresight Research expects a 2.0{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} increase in the size of the US drugstore sector in 2022, following growth of 7.1{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} year over year in pandemic-impacted 2021. We expect to see a steady increase in year-over-year growth in drugstore sales from fiscal 2022.

Now, as Covid-19-driven sales drop and vaccination and testing drives wind down, the growth of the drugstore sector will slow in 2022 and early 2023. Moreover, as consumer purchases of over-the-counter (OTC) medicines and cleaning supplies decline after the spike in demand during the pandemic, the significant front-end sales generated by drugstore chains will also weaken. Nevertheless, we expect sector sales to be 9.3{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} higher in 2022 versus 2020.

We expect the drugstore sector to grow at a CAGR of 2.5{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} in the 2022–2026 period. Drugstores are adopting various digitalization programs to cater to growing consumer demand and form a more profitable business model, which we expect to drive growth in the market.

Figure 1. US Drugstores’ Total Sales (Left Axis; USD Bil); and YoY{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} Change (Right Axis; {2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0})

Market Factors

Global supply chain challenges, labor shortage problems, and rising inflation will likely continue to be major challenges for the industry into 2023. Nevertheless, in the medium and long term, various factors such as the aging population, an increase in chronic illnesses and consumers’ focus on health and wellness will influence the sector positively, leading to overall growth.

Driving Forces

Rise in Aging Population

The number of people aged 65 and above increased by 34.2{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} in the US from 2010 to 2019, and by 3.2{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} between 2018 and 2019, and is expected to account for approximately 20.0{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} of the US’s total population by 2030, according to the US Census Bureau. There is potential for the drugstore sector to benefit from this demographic shift as the demand for medicines—particularly those for chronic diseases—will escalate.

Rise in Chronic Illnesses

The US healthcare system is dealing with an increased burden of chronic illnesses and rising prescription costs. According to Centers for Disease Control and Prevention (CDC), six out of 10 Americans have at least one chronic disease, such as heart ailments, stroke, cancer or diabetes, with the number likely to rise. This will result in a sustained increase in the demand for prescription drugs. As new opportunities emerge to expand beyond their traditional role of filling prescriptions and provide more comprehensive services to their customers, drugstores may play a critical role in providing patient care and access to primary healthcare services.

Growing Consumer Interest in Health and Wellness

The pandemic has altered many consumers’ perceptions of the importance of their health. According to a study undertaken by CVS Health, people care more about their health than they did before the pandemic: Some 22{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} of respondents indicated that Covid-19 has led them to care about their health more than ever before, while 44{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} have embraced new health habits or goals specifically because of the pandemic, and 12{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} have considered adopting new health goals. More consumers seeking to adopt a healthy lifestyle will significantly contribute to the market expansion of drugstores. The fear of a pandemic is no longer keeping people from getting checkups or screenings; instead, they are eager to continue their paths toward health and wellness. As consumers re-evaluate their lifestyle, health and fitness goals, and disease prevention mechanisms, drugstores will look to leverage this factor to drive sales of health-aligned products such as nutritional food and drinks, OTC remedies, and health and wellbeing consultation services.

Potential Headwinds

Supply Chain Challenges

The Covid-19 pandemic and Russia’s invasion of Ukraine have caused unprecedented supply chain disruption, leaving companies unable to predict supply or meet delivery deadlines. The majority of essential components and raw materials used to make drugs and devices are produced in China. According to the Center for Drug Evaluation and Research of the US Food and Drug Administration, China is home to about 13.0{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} of the facilities that manufacture active pharmaceutical ingredients (API). China is also a major producer of antibiotics for the US market as well as ingredients and medications for common chronic conditions such as heart disease; it is ranked third among nations that export drugs and biotech medicines to the US. Lockdowns in China continue to severely disrupt supply chains and could hamper the growth of the pharmaceutical industry in the near future.

Labor Shortages

According to the US Labor Department, the US has 5.5 million more job openings than there are workers available to fill them, and it is anticipated that this acute shortage of labor will continue in the near future, negatively impacting the US economy. The labor shortage has driven up wages and fueled inflation to its highest levels in decades. Walgreens stated in its fourth quarter of fiscal 2022 earnings call that with demand for pharmacy services at an all-time high due to Covid-19, it has seen a tightening in the labor market for pharmacists and pharmacy technicians, which led to staffing shortages in some of its markets, creating a headwind for prescription growth. In June, Walmart raised pharmacy technicians’ average hourly wage to more than $20 per hour and is planning to hire around 5,000 additional technicians in 2022.

Inflation

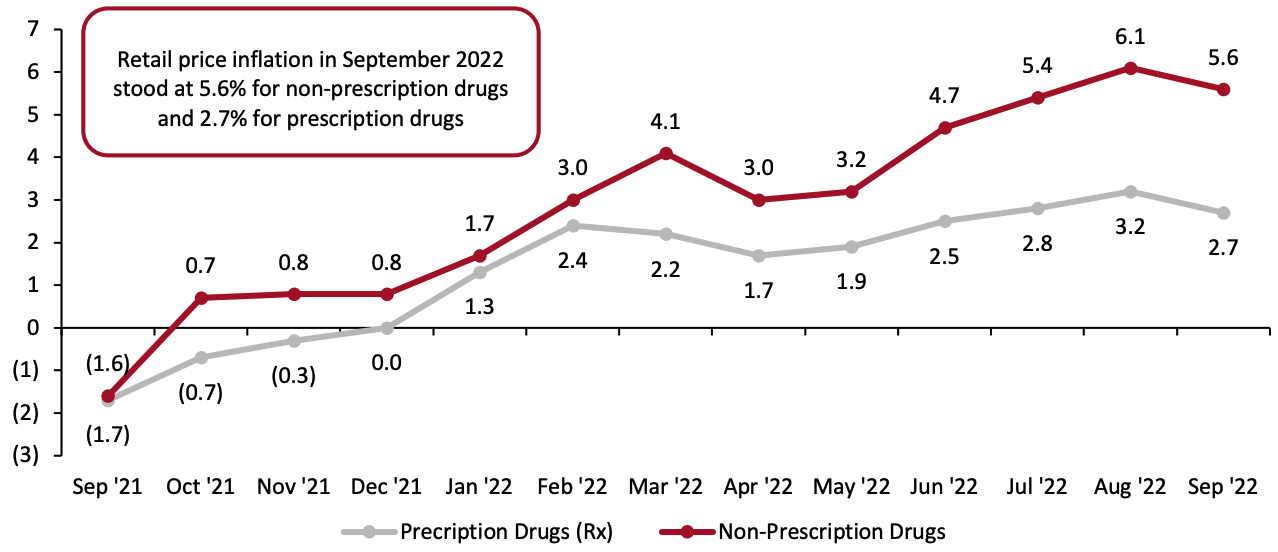

Inflation of consumer goods and services has been on the rise over the past year, reaching a high of 8.2{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} year over year in September 2022. CPI for both prescription and non-prescription drugs has been increasing since April 2022, although slightly slowed in September 2022, with a 3.2{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} increase in prescription drugs and a 6.1{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} increase in non-prescription drugs on a year-over-year basis. The upward price trend may reflect supply chain and wage inflation pressures, which may negatively impact drugstores’ margins.

Figure 2. YoY Inflation ({2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} Change in CPI) in Prescription (Rx) and Non-Prescription Drugs in the US

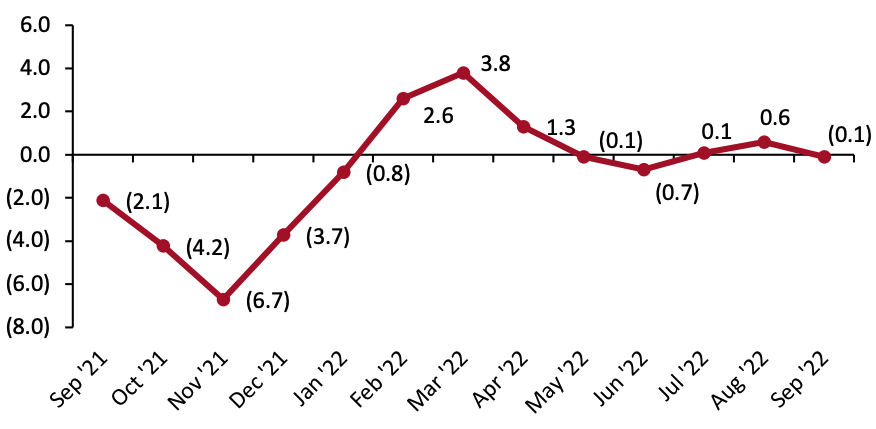

PPI for pharmacies and drugstores peaked at 3.8{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} in March as a result of rising supply chain costs, brought on by skyrocketing international freight costs and rising commodity prices. This has negatively impacted the drugstore sector’s profit margins, prompting some players to pass the cost increases on to consumers.

Supply chain bottlenecks are likely to persist through the remainder of 2022 (although they have slowly improved from July onwards), resulting in a stable rise in retail prices of pharmaceutical drugs, which had been declining for the majority of 2021.

Figure 3. Producer Price Index: Pharmacies and Drugstores (YoY {2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} Change)

Online Market

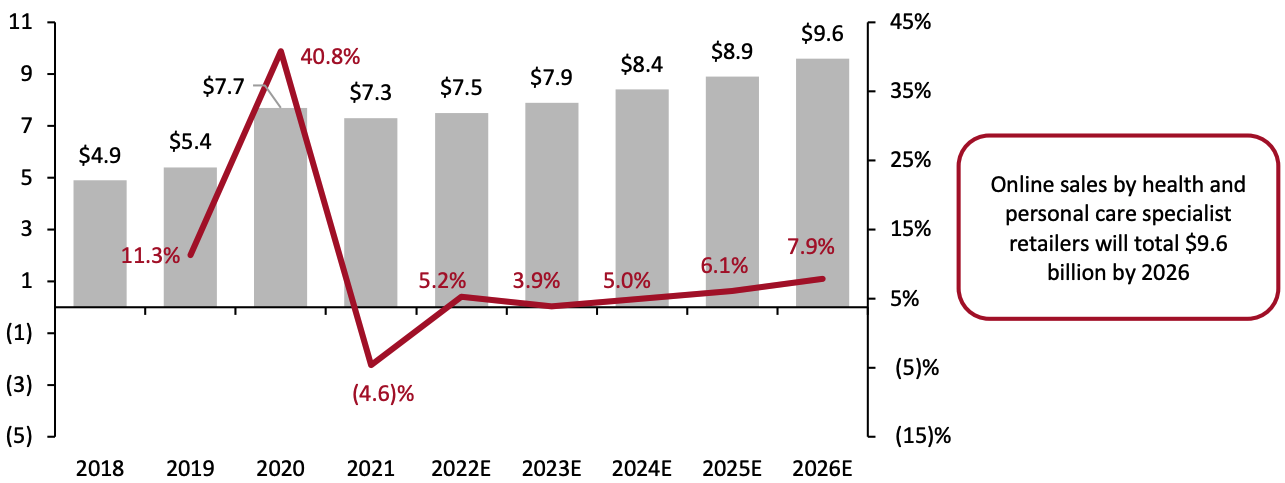

Coresight Research expects online sales by health and personal care specialist retailers (which includes drugstores) to see a slight increase, rising from $7.3 billion in 2021 to $7.5 billion in 2022, as shown in Figure 4. The health and personal care stores sector includes non-drugstore retailers such as opticians and beauty retailers.

Increased in-store traffic after the easing of lockdown restrictions decreased online sales; in the long term, however, online health and personal care sales will rise, with the expansion of large players such as Amazon (which recently acquired telehealth company One Medical) in the sector playing a key role. We expect the online market to continue to grow, owing primarily to increased consumer adoption driven by convenience, affordability and accessibility. Moreover, we expect the online health and personal care market to grow at a CAGR of 4.0{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} from 2022 to 2026—the presence of fraudulent online pharmacies and the sale of unapproved prescription drugs may hinder consumer confidence in purchasing these products online, preventing the online market’s expansion at a faster pace.

The rise in direct-to-patient drug sales, increased adoption of e-prescriptions among US customers, automated prescription filling and automated customer relationship management are major factors driving the growth of online pharmacies in the US.

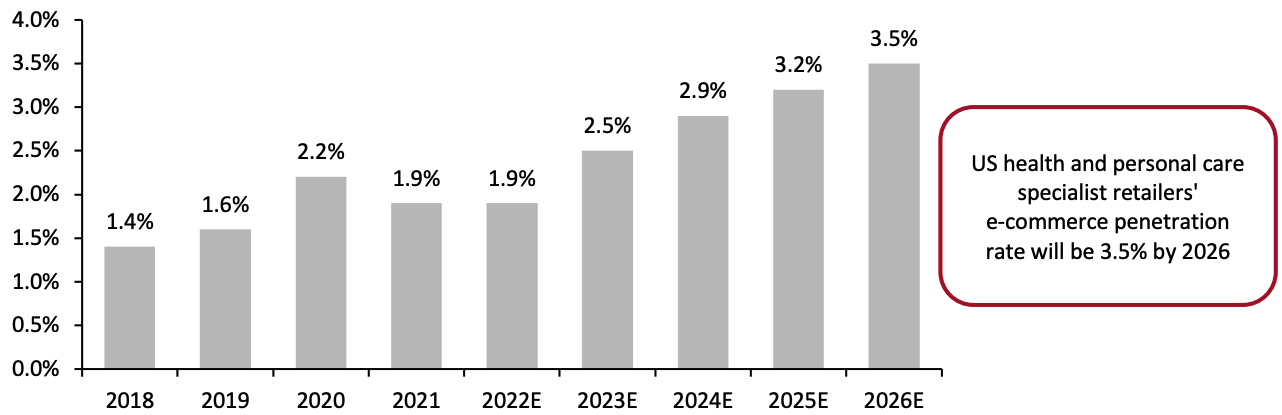

We estimate that US health and personal care specialist retailers’ e-commerce penetration rate to be 1.9{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} in 2022, totaling 3.5{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} by 2026. As the digital world expands and new services and consumer-friendly online experiences emerge, the market is shifting toward the direct-to-patient model. The convenience and familiarity of online purchasing entices many patients to look for virtual care and wellness options.

Figure 4. US Health and Personal Care Specialist Retailers’ Online Sales (Left Axis; USD Bil.) and YoY {2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} Change (Right Axis; {2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0})

Figure 5. US Health and Personal Care Specialist Retailers’ E-Commerce Penetration Rate

Competitive Landscape

The retail drugstore sector in the US is comprised of small independent pharmacies and a very small number of large chains, which are licensed to dispense prescription medication, combined with general retail stores, which deal in OTC medication, personal care and beauty products and general merchandise. Walgreens and CVS Health dominate the sector, with Rite Aid the third major player.

The US retail pharmacy industry is highly competitive. The number of alternative providers such as e-pharmacies, grocery chains and mass merchants has grown steadily in the past few years. Many of these competitors aggressively advertise to capture market share. Larger chains benefit from competitive advantages such as numerous locations, pricing power, strong brand recognition and sophisticated technology. Independent pharmacies remain competitive by offering better customer service and specialized products in their local areas. Smaller pharmacies also focus on niches such as services for high-risk patients and those with special needs to remain competitive.

Leading Companies

The fact that Walmart is now one of the top five retailers of medicines and other healthcare products demonstrates the increased competition the drugstore sector faces from general merchandise and food retailers. Walmart, Target and Kroger are among the prominent discount and supermarket chains that have gained market share in the pharmacy business. Many regional and national supermarket chains have significant pharmaceutical departments. This competition has forced industry leaders to adjust: Leaders Walgreens and CVS Health have expanded significantly into general merchandise and food categories to compete. Loyalty programs have also become popular ways to capture and retain customers. Large and small chains have worked diligently with manufacturers and wholesalers to offer discount drug programs to compete on price as well.

The market for prescription drugs is highly concentrated, with the top three retailers being CVS Health, Walgreen Boots Alliance and Walmart, who together account for nearly half (48.0{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0}) of the market. Market giants such as CVS Health and Walgreens have increased their market share faster than smaller drugstore chains, which face increased competition from Walmart and other independent pharmacies. In October 2022, Albertsons and Kroger announced that they have entered into a definitive agreement under which the companies plan to merge, with Kettle Merger Sub, Inc. overseeing the merger. As each of the grocery giants operates in areas where the other does not, a merger would result in a massive combined national footprint, reaching more customers across the US.

Figure 6. Major Drugstore Chains and Pharmacies Revenues (USD Bil.)

*Health and wellness includes pharmacy, OTC drugs and other medical products, optical services and other clinical services.

**The top eight retailers sum up to more than the drugstore market size in 2021 because some players are not included in the drugstore sector and are counted in other sectors. Moreover, Walmart’s revenue includes more than the pharmacy and OTC revenues.

Walgreens’s fiscal year ends on August 31, CVS Health’s on December 31, Walmart’s and Kroger’s on January 31, Rite Aid’s on February 28, Albertsons’s on February 28, and Publix’s and Ahold Delhaize’s on December 31

Source: S&P Capital IQ/company reports/Drugs Channels Institute

Store Numbers and Changes

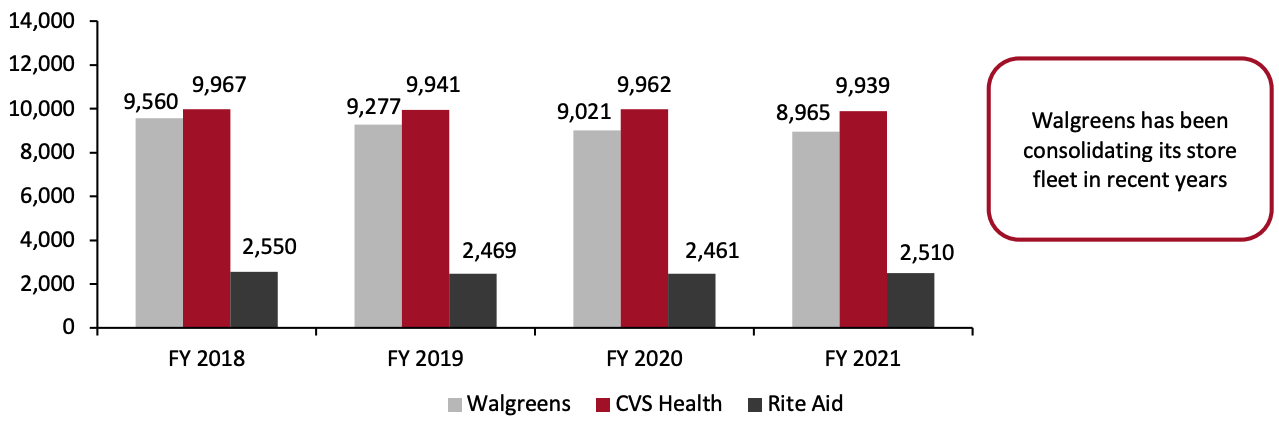

Store closures are the norm among the major drugstores, continuing a multiyear trend of consolidation of locations in the drugstore sector, which comes at a time when major retailers are increasing their investments in digitalization and expanding their reach into healthcare services. Walgreens operated 8,965 retail stores as of August 31, 2021, down from 9,021 in 2020. The retailer has been consolidating its store fleet in recent years, with hundreds of closures (dominated by closing a tranche of acquired Rite Aid stores) in the past five years. Similarly, CVS Health operated 9,939 stores as of December 31, 2021, versus 9,962 at the end of 2020 (including locations in Target stores). It is reshaping its store portfolio with stores categorized into three formats: primary care clinics, enhanced HealthHUBs and traditional pharmacies. CVS Health is aiming to redesign its stores based on consumer needs, omnichannel shopping preferences and changes in the US population. Rite Aid operated 2,510 stores as of February 2022, down from 2,461 stores as of February 2021.

Figure 7. Walgreens, CVS Health and Rite Aid Store Count (at Fiscal Period End)

Source: S&P Capital IQ/company reports

Where Consumers Are Shopping and What They Are Buying

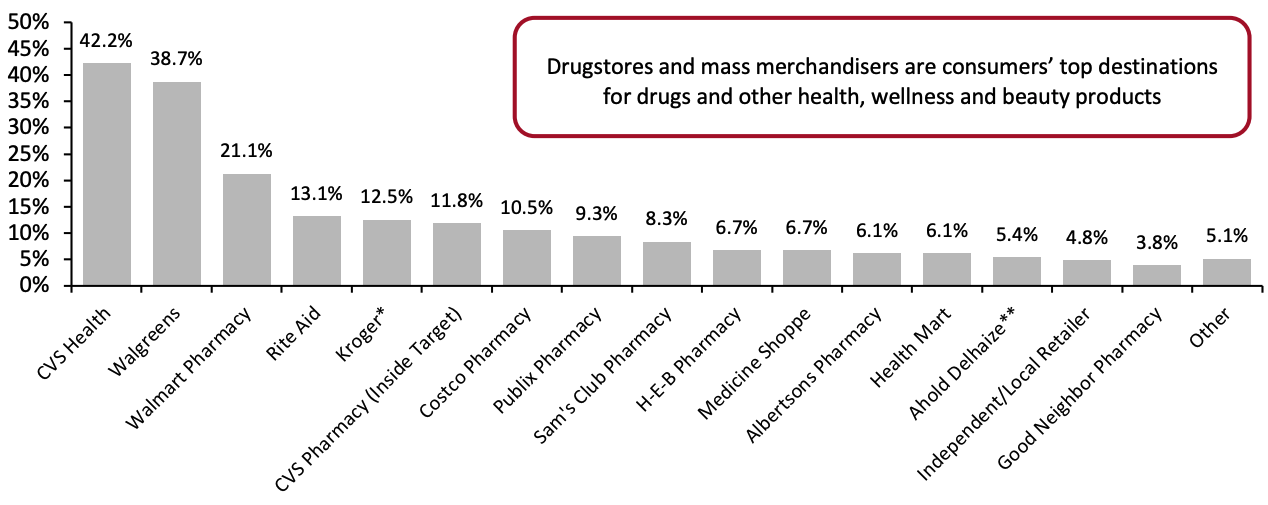

Some 69.0{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} of respondents bought products from drugstores or pharmacies in the previous three months, according to a Coresight Research survey conducted on August 8, 2022. CVS Health, Walgreens and Walmart are the three most-shopped retailers among drugstores and pharmacies.

Our findings indicate that drugstores and mass merchandisers are the top destinations for customers’ purchases—mainly due to easy access to these stores, with 90{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} of the US population living within five miles of a drugstore or mass merchandiser.

Figure 8. Respondents Who Purchased from a Drugstore or Pharmacy in the Three Months to August 2022: Retailers Purchased From ({2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} of Respondents)

*Kroger banners specified as City Market, Dillons, Fred Meyer, Fry’s, Harris Teeter, King Soopers, Kroger, Ralphs and Smith’s Food & Drug

**Ahold Delhaize banners specified as Food Lion, Giant, Hannaford and Stop & Shop

Source: Coresight Research

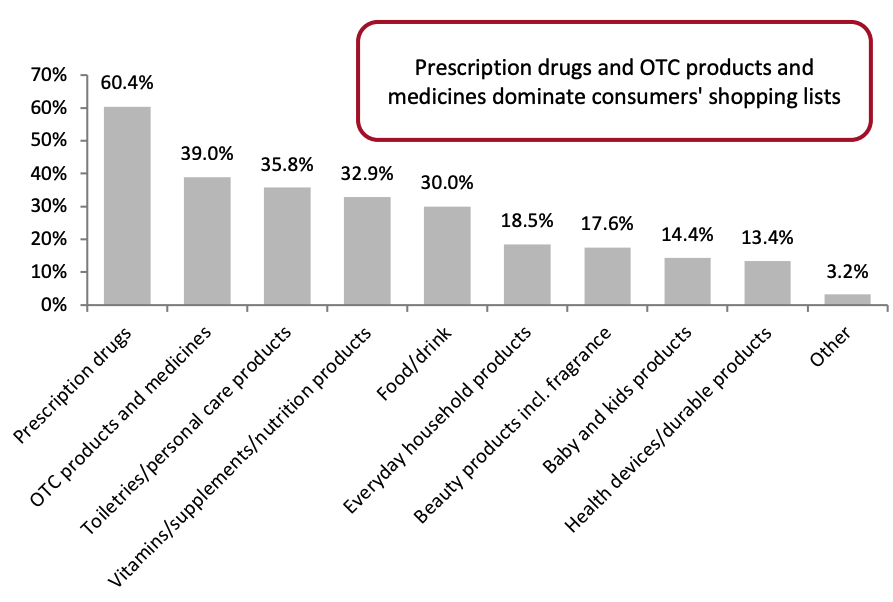

OTC products and medicines, prescription drugs and personal care products are the top three categories US shoppers bought from drugstores and pharmacies, according to our survey. Prescription drugs and OTC products and medicines had the largest share, due to an extended cold and flu season lingering later into the spring combined with increased sales of Covid-19 test kits.

Figure 9. Respondents Who Purchased from a Drugstore or Pharmacy in the Three Months to August 2022: Categories Purchased ({2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} of Respondents)

Source: Coresight Research

Themes We Are Watching

Industry Giants Accelerate Their Digital Transformation

The pharmaceutical industry was already undergoing a digital transformation before the Covid-19 pandemic. The adoption of digital technologies and media has, however, been significantly accelerated in the pharmaceutical industry (as well as in the healthcare systems it supports) due to its abrupt, enforced shift into the virtual world. The global pandemic has provided additional motivation for patients to use digital technologies to manage their health. The drugstore giants have been expanding their digital presence in an effort to adapt to changes in consumer behavior and preferences.

CVS Health stated in its first quarter of fiscal 2022 earnings call that the company is focused on its digital-first, technology-forward approach and has expanded its digital-first health dashboard offering, which makes managing the health of a family more seamless, convenient, and personalized. It accomplishes this by centralizing critical health information, such as health records, pharmacy medications, and recommended actions, as its digital customers grew by 7 million during the first quarter of fiscal 2022. Moreover, on its fiscal 2022 third-quarter call, the company said that it has introduced a new functionality that gives more options and convenience for patients when filling prescriptions. Patients can expedite urgent prescriptions, see their out-of-pocket costs and track the status of their orders before even visiting the pharmacy.

Rite Aid stated in its first quarter of fiscal 2023 earnings call that the company is enhancing its digital capabilities and expanding its buy online, pick up in store (BOPIS), mail and delivery services. These services include both prescriptions and retail goods, forming a one-stop shopping experience.

Telehealth company MeMD changed its name to Walmart Health Virtual Care in May 2022 to reflect the company’s acquisition by Walmart Health in May 2021. It aims to provide as many organizations as possible with affordable, high-quality telehealth options. MeMD’s current patients and employers will now have access to a broader range of additional health offerings through the Walmart Health umbrella.

Pharmaceutical Industry Leverages Artificial Intelligence To Improve Efficiency

Pharmaceutical companies are looking for ways to leverage artificial intelligence (AI) and machine learning (ML) within the healthcare and biotech industries. Many expect to use these technologies to improve decision-making, increase innovation, improve the efficiency of research and clinical trials, and create new tools for physicians, consumers, insurers and regulators. AI has the potential to transform drug discovery by accelerating the research and development timeline, making drugs more affordable and improving the probability of US Food and Drug Administration (FDA) approval. AI can perform quality control, reduce waste, improve production reuse, and perform predictive maintenance. ML can help forecast and prevent over-demand and under-demand, and fix supply chain problems and failures in the production line.

CVS Health and Microsoft have announced a collaboration that aims to accelerate the digital health transformation through AI and cloud computing, and personalize CVS Health’s customer experience using AI, ML, data and analytics. In December 2021, the company announced a partnership with Microsoft to scale up retail personalization and loyalty programs using advanced ML and Microsoft’s cloud computing platform, Azure. CVS Health now uses ML to resolve a wide range of prescription drug claims, which previously required the attention of its pharmacists, who now have more time to spend with patients.

Walgreens, meanwhile, is focusing on building out customer profiles, offering personalization to its customers, advancing its online dispensing system and giving consumers more management of prescriptions online. For this, Walgreens has signed a partnership with Microsoft and Adobe to offer one-to-one communications with consumers and to deliver tailored prescription experiences online. Adobe’s Customer Experience Management (CXM) solutions, another aspect of the partnership, will offer analytics, content management, personalization and campaign orchestration services online.

in June 2022, Walmart entered into an agreement to acquire Memomi, an augmented reality (AR) optical tech company. Memomi has enabled digital measurements for all Walmart and Sam’s Optical customers across more than 2,800 Walmart Vision Centers and 550 Sam’s Clubs since 2019, including through SamsClub.com. This acquisition advances Walmart’s stated health and wellness strategy of delivering integrated, omnichannel healthcare through the use of data and technology to improve engagement, health equity and outcomes.

In July 2022, BD (Becton, Dickinson and Co.), a global medical technology company, completed the acquisition of Parata Systems, a provider of pharmacy automation solutions. Parata advances BD’s transformative solutions strategy by offering a portfolio of innovative pharmacy automation solutions that power a growing network of pharmacies to reduce costs, improve patient safety, and improve the patient experience for retail, hospital and long-term care pharmacies.

Drugstores and Pharmacies Expand Their Beauty Assortment

The convergence of growth trends in wellness and beauty positions drugstore retailers for front-end growth in 2022. Consumers’ new pandemic-driven interest in healthier living is driving up sales of self-care products, particularly skincare, foot care and bath items. In addition, consumers’ return to work and socializing has provided a much-needed boost to the makeup industry. The drugstores have made some major strides in renovating their assortments, bringing in new brands and highlighting brands that have the ingredients shoppers want.

Walgreens, for instance, added product lines from Revolution Beauty, a British-based skincare and cosmetics company, and Hey Humans, an eco-conscious personal care brand, in spring 2022. Walmart and CVS Health, meanwhile, added Sera Labs’ Seratopical Revolution skincare brand in April 2022, While Target now sells the company’s Nutri-Strips online.

Expansive Health Services by Drug Retailers

As the healthcare landscape evolves in the aftermath of the pandemic, drug retailers see retail healthcare as a critical component of their growth strategies.

Drug retailers are reshaping the whole US health and wellness segment, with expansive pharmaceutical services: Walgreens, for example, has invested heavily in VillageMD in order to have doctors inside their stores in remote areas. CVS Health is also investing to ensure every CVS Health pharmacy has a nearby CVS Health physician. Similarly, Walmart is putting clinics in some of its facilities. In these various ways, retailers are bringing the healthcare provider and the pharmacy closer together.

Walgreens is seeking to create a network of industry-leading healthcare service providers to help consumers build relationships with primary care professionals, pharmacists and in-home care teams in their communities. Walgreens is continuing its rollout of co-located VillageMD clinics and expects to have opened 200 by the end of 2022. Currently VillageMD operates in 22 US states and serves over 1.6 million patients. Shortly before we published, in 2022, VillageMD agreed to acquire Summit Health-CityMD a leading provider of primary, specialty and urgent care. Together, VillageMD and Summit Health will have more than 680 provider locations in 26 markets in the US.

CVS Health is diversifying its growth portfolio with new health services. The company is expanding its capabilities in home health as it prepares for the 2023 launch of a post-acute transitions pilot for its Aetna membership in select geographies. The company has also expanded its HealthHUB Minute Clinics format, which aims to transform the role of its retail stores by providing expanded health services, telehealth visits, pharmacy support and a variety of wellness products. Its MinuteClinics have seen more than 2.8 million patient visits year-to-date.

Retail Innovators

- Homeward, launched in March 2022 with an initial investment of $20 million from General Catalyst, looks to bolster access to high-quality, affordable primary and specialty care in rural areas. Homeward deploys a hybrid model of care to increase access to primary care and specialty services, and uses cellular-based monitoring devices and virtual services to better connect to remote patients. In May 2022, Rite Aid collaborated with Homeward, to provide an integrated pharmacy and clinical services offering to their shared customers in rural areas.

- Medly Pharmacy, founded in 2017, is a digital pharmacy under parent company Medly Health that offers free same-day prescription delivery and also validates and files insurance claims. Medly works with drugstores and patients to personalize every aspect of the healthcare journey. Founded in 2018, Medly Pharmacy has raised a total of $100 million in funding over four rounds; its latest funding was raised on June 1, 2021, from a Series C round.

- Clearstep is a platform for health systems to provide a complete digital experience. Its artificial intelligence (AI) care navigation platform matches patients to the right care based on their symptoms, insurance and location, helping them book the best in-person or virtual care. Founded in 2018, the company has so far received $5 million in funding.

- GoGoMeds, founded in 2017, is a cloud-based pharmacy utilizing technology to provide customers with convenient and affordable quality medications delivered to their door. GoGoMeds is owned and operated by Specialty Medical Drugstore, which is part of the Fortis Holding Company. The company’s digital platform allows patients to upload e-prescriptions provided by doctors on the platform. Pharmacies provide medication and also have tools to auto-refill medication for patients.

- Gifthealth, founded in 2020, is a healthcare technology start-up that streamlines the pharmacy experience with free delivery and competitive medication pricing. The company’s software searches for nearby pharmacies with the required drugs in stock at the beginning of a prescription transaction, and the platform automatically applies discounts and coupons from drug makers and locates the nearest pharmacy. Gifthealth works with a nationwide network of pharmacies to get the best prices for its clients.

What We Think

The drugstore sector is likely to see slower growth in 2022 versus 2021 as pandemic-driven sales will likely subside. However, we expect the market to grow around 9.3{2c3a8711102f73ee058d83c6a8025dc7f37722aad075054eaafcf582b93871a0} on a two-year basis. We expect the sector to continue to face supply-chain challenges caused by rising shipping costs, labor and wage issues and inflation for the remainder of 2022. Considering this, we believe that the drugstores will make strategic price adjustments and strive for cost reductions in order to remain competitive and appeal to customers.

In 2022, we will see more in-store purchases than in 2021. Walgreens, for instance, stated in its third quarter of fiscal 2022 earnings call that it is seeing higher levels of traffic to its stores. Nonetheless, online purchases of pharmaceutical drugs will continue to exceed pre-pandemic levels through 2022.

Online drugstore sales will continue to grow, and small businesses as well as new startups will seek to increase their market share. We believe that consumer satisfaction will be critical, and the pandemic has raised consumers’ expectations as they seek lower costs, better services, convenience and personalization. Online pharmacies are posing stiff competition to the established market players. As a result, we believe that market leaders will rethink and redefine how they connect with their customers and expand their digital presence. We have already seen industry leaders such as CVS Health and Walgreens looking to increase customer interaction through digital platforms, as well as Rite Aid prioritizing digital expansion to reach out to more consumers.

Drugstores will strive to increase their customer base by providing better services. As more customers avoided physical stores during the pandemic and purchased medications online, via drive-through pickup or by mail, drugstores have adopted new strategies to attract more in-store customers, such as offering value-based, comprehensive health services.

Implications for drugstores

- The way forward for drugstores will be to ensure customer satisfaction through consumer-driven insights and leveraging data in meeting customers where they are. Insights and data-gathering using AI and machine learning will help these companies to focus on consumers’ needs in order to provide value that goes beyond one-time transactions and establishes long-term relationships.

- Consumers will now expect fast, convenient and meaningful one-to-one interactions with healthcare providers like pharmacists, as pandemic-driven telehealth trends will continue for some consumers.

- As competition from mass merchandisers and supermarkets intensifies, shifting customer expectations and a changing industry landscape will force drugstores to further enhance and transform their roles. The drugstore giants will invest heavily in omnichannel pharmacy retailing to connect all their pharmacy resources. By delivering coordinated retail, specialty and mail-order pharmacy all in one place they envision a digital-first approach to pharmacy interactions that will change the consumer experience and give customers maximum convenience.

- Drugstores will also deepen their commitment to health and wellness with new and exciting differentiated merchandise and store brands that help make pharmacies a destination of choice, providing exceptional care, personalized products and value.